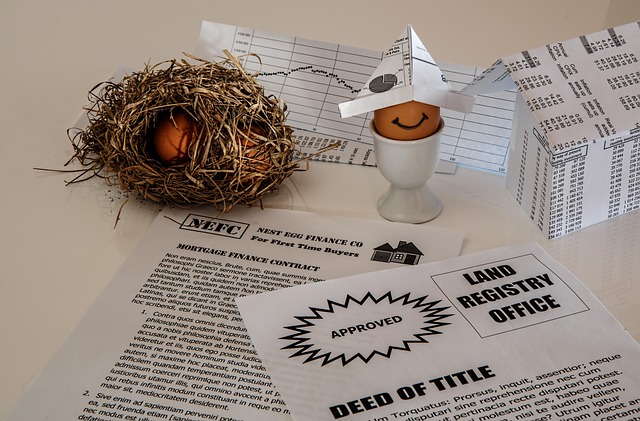

In competitive League City, Texas, League City title loans offer swift cash access backed by a borrower's vehicle, serving as an alternative to traditional credit-based lending. With minimal focus on credit scores and extensive documentation evaluation based on vehicle equity, these loans cater to individuals with limited or no credit history, providing both short-term relief and an opportunity for long-term financial stability exploration.

Looking for a fast and flexible financing option in League City? League City title loans offer a unique solution. This comprehensive guide breaks down the process behind these loans, explaining how they work step-by-step. From understanding the basics of League City title loans to exploring their numerous benefits and considerations, this article provides everything you need to know. Discover why many choose this method for their short-term financial needs.

- Understanding League City Title Loans: A Comprehensive Overview

- How Do League City Title Loans Work? The Step-by-Step Process

- Benefits and Considerations: Why Choose League City Title Loans?

Understanding League City Title Loans: A Comprehensive Overview

In the competitive financial landscape of League City, Texas, understanding League City title loans is crucial for individuals seeking quick and accessible funding solutions. These innovative financing options are secured loans backed by an asset—typically a motor vehicle, such as a car or truck. Unlike traditional loans that rely heavily on credit scores, League City title loans offer flexibility to those with less-than-perfect credit, including individuals with bad credit. This alternative lending approach has gained popularity due to its simplicity and potential benefits for borrowers.

The process involves the borrower submitting an application, providing necessary documents, and allowing a lender to assess their vehicle’s value. Once approved, funds are disbursed, offering a reliable source of capital for various needs. It’s important to note that while these loans provide a quick fix, responsible borrowing practices should be prioritized. With clear terms and conditions, borrowers can leverage League City title loans as a short-term solution while exploring long-term strategies for financial stability.

How Do League City Title Loans Work? The Step-by-Step Process

League City title loans offer a unique financial solution for individuals seeking quick cash access. The process is designed to be straightforward and efficient, catering to those in need of immediate financial support. Here’s how it works:

1. Application and Assessment: Potential borrowers can apply for League City title loans online or through a direct visit to the lender’s office. They will be required to provide essential documentation, including proof of vehicle ownership (vehicle registration and title), a valid driver’s license, and proof of income. The lender assesses the applicant’s eligibility based on these documents and their vehicle’s equity value.

2. Equity Evaluation: The next step involves assessing the borrower’s vehicle equity. Lenders use the market value of the car, truck, or SUV as collateral to determine how much they can lend. Unlike traditional loans that often require a credit check, League City title loans prioritize the vehicle’s worth, making it an excellent option for those with less-than-perfect credit or no credit at all. This no-credit-check approach ensures accessibility for many individuals.

Benefits and Considerations: Why Choose League City Title Loans?

League City title loans offer a unique financing option for residents seeking quick access to cash. One of the primary benefits is their ease of access; unlike traditional bank loans, they require minimal paperwork and often have faster approval times. This makes them an attractive choice for those in need of immediate financial support. For instance, if you’re facing an unexpected expense or emergency and need a short-term solution, League City title loans can provide a reliable option with flexible Loan Terms.

Additionally, these loans are beneficial for individuals who may have limited credit options due to poor credit scores or lack of traditional credit history. Unlike Houston title loans that often require extensive credit checks, League City title loans focus more on the value and ownership of an asset, such as a vehicle, rather than the borrower’s creditworthiness. This allows more people to access much-needed funds, providing a safety net during challenging financial periods.

League City title loans offer a unique financing solution for individuals seeking quick access to capital. By understanding the process, from initial application to final repayment, borrowers can make informed decisions. This comprehensive guide has highlighted the benefits and considerations of choosing League City title loans, streamlining the loan process for those in need. When considering short-term funding, keeping these insights in mind ensures a smoother experience and empowers individuals to navigate their financial options effectively.