League City title loans offer quick cash using vehicle equity, appealing to those with less-than-perfect credit as they have higher approval rates than personal loans. To secure the best deal, compare lenders, negotiate terms, and stay informed about fee structures and promotions. Responsible borrowing involves understanding credit checks' impact, budgeting, and accelerating repayment to minimize interest. Despite credit issues, secured nature simplifies access to financial aid through League City title loans.

Looking for a quick financial solution in League City? League City title loans offer a unique opportunity, allowing you to access cash using your vehicle’s title as collateral. Understanding this process is key to getting the best deal. This article guides you through the basics, provides strategies for securing favorable terms, and offers tips for effortless repayment of your League City title loan.

- Understanding League City Title Loans: Basics Explained

- Strategies to Secure Best Deal for Title Loans in League City

- Top Tips for Repaying Your League City Title Loan Effortlessly

Understanding League City Title Loans: Basics Explained

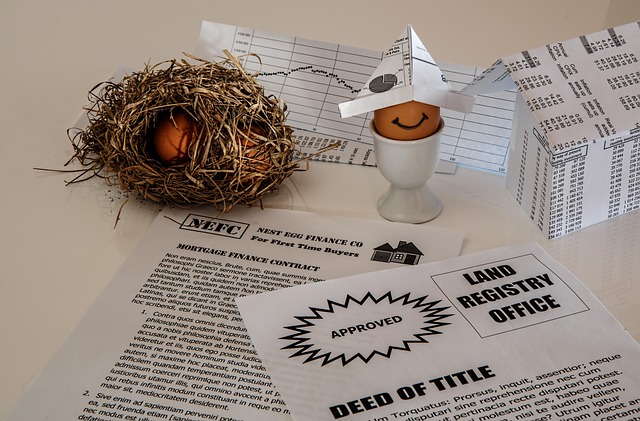

League City title loans are a financial solution that allows individuals to borrow money using their vehicle’s equity as collateral. This type of loan is designed for those who need quick access to cash and have a qualifying motor vehicle. The process involves assessing the value of your vehicle, which determines the loan amount you can secure. Once approved, you’ll receive funds, and in return, you’ll make payments over a set period, with the right lender offering flexible payment plans.

These loans are appealing due to their quick approval times, often within hours, and they provide an alternative to traditional bank loans. The key advantage lies in the fact that even if your credit score is less than perfect, you can still gain access to funds since the loan is secured against your vehicle, ensuring a better chance of approval compared to unsecured personal loans.

Strategies to Secure Best Deal for Title Loans in League City

Securing the best deal with League City title loans involves a strategic approach to ensure you get the most favorable terms. First, compare multiple lenders in the area to understand market rates and fees. This process empowers you to negotiate better terms and avoid exploitative practices. Additionally, consider your financial situation and only borrow what you can comfortably repay to maintain a good credit score.

One effective strategy is to shop around for offers that include transparent fee structures and flexible repayment plans. Some lenders may offer discounts or promotions, so staying informed about these opportunities can lead to significant savings. Moreover, understanding the impact of a credit check on your loan terms can help you make informed decisions, as minimal or no-credit checks often come with higher interest rates. Opting for quick funding while ensuring responsible borrowing practices ensures you receive the financial assistance you need without unnecessary strain on your finances.

Top Tips for Repaying Your League City Title Loan Effortlessly

When it comes to repaying your League City title loan, a well-planned strategy can make the process as smooth as possible. First, set up a budget that allocates a specific portion for loan repayment each month. This ensures consistent progress towards settling your debt. Remember, the faster you pay off the loan, the less interest you’ll accumulate.

Consider leveraging additional income sources or cutting unnecessary expenses to expedite repayment. For those with less-than-perfect credit, bad credit loans like League City title loans offer a unique advantage due to their secured nature. This means your vehicle’s title acts as collateral, providing lenders with a buffer against default. The Title Loan Process is designed to be straightforward, making it accessible for many individuals seeking financial support.

League City title loans can provide much-needed financial support, but securing the best deal requires understanding and strategic planning. By familiarizing yourself with the basics, employing effective negotiation tactics, and adopting smart repayment strategies, you can make the most of this type of loan. Remember, responsible borrowing and thoughtful management are key to ensuring a positive experience with League City title loans.